If you’re like most people, you aren’t eager to spend time thinking about what would happen if you became unable to direct your own medical care because of illness, an accident, or advanced age. However, if you don’t do at least a little bit of planning — writing down your wishes about the kinds of […]

How Long to Keep Important Documents

Some financial documents need to be kept, but others can be shredded and tossed. Here’s a guide on what to keep and for how long.

If you haven’t already opted to go paperless, you might be swimming in a flood of receipts, bills, pay stubs, tax forms and other financial documents. But it doesn’t have to be that way. Start 2020 off right with this revelation: You can go paperless! Some of those papers you have collected need to be kept, but others can be shredded and tossed.

Here’s a guide of which financial documents to keep and for how long.

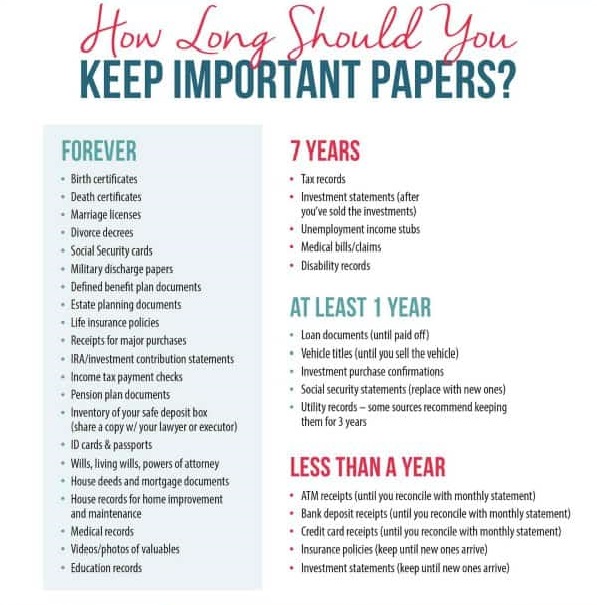

RECEIPTS

Receipts for anything you might itemize on your tax return should be kept for three years with your tax records.

HOME IMPROVEMENT RECORDS

Hold these for at least three years after the due date of the tax return that includes the income or loss on the home when it’s sold. If you plan to sell the house, and you have made improvements to it, keep receipts for those improvements for seven years — you may need them to lower the taxable gain on the house when you sell it.

MEDICAL BILLS

Keep receipts for medical expenses for one year, as your insurance company may request proof of a doctor visit or other verification of medical claims. If your medical expenses totaled more than 7.5% of your adjusted gross income in 2017 or 2018, you can deduct them—but remember, starting the beginning of this year (Jan. 1, 2019), you may only deduct the amount of the total unreimbursed allowable medical care expenses for the year that exceed 10% of your adjusted gross income. If you take that deduction, you’ll need to keep the medical records for three years for tax records.

PAYCHECK STUBS

Keep pay check stubs until the end of the year, and discard them after comparing to your W-2 and annual Social Security statements.

UTILITY BILLS

Keep for one year and then discard — unless you’re claiming a home office tax deduction, in which case you must keep them for three years.

CREDIT CARD STATEMENTS

Keep until you’ve confirmed the charges and have proof of payment. If you need them for tax deductions, keep for three years.

INVESTMENT AND REAL ESTATE RECORDS

Keep for three years, as you may need the documentation for the capital gains tax if you’re audited by the IRS. These records help track your cost basis and the taxes you owe when you sell stocks or properties. Once you receive the annual summaries, you can shred your monthly statements.

BANK STATEMENTS

You’ll need bank statements for up to three years if you are audited by the IRS. If your bank provides online statements, you can switch to receiving your bank documents online and cut down on paper.

TAX RETURNS

The IRS recommends that you “keep records for three years from the date you filed your original return or two years from the date you paid the tax, whichever is later.” If you file a claim for a loss from worthless securities or bad debt deduction, keep your tax records for seven years.

RECORDS OF LOANS THAT HAVE BEEN PAID OFF

Keep for seven years.

ACTIVE CONTRACTS, INSURANCE DOCUMENTS, PROPERTY RECORDS OR STOCK CERTIFICATES

Keep all these items while they’re active. After contracts are completed or insurance policies expire, you can discard these documents.

MARRIAGE LICENSE, BIRTH CERTIFICATES, WILLS, ADOPTION PAPERS, DEATH CERTIFICATES OR RECORDS OF PAID MORTGAGES

Keep these documents forever.

Got the Book?

Take the 30 Day Challenge: Get your crap together, so your Family won’t have to!

You have your choice of two options. Yup I’m Dead…Now What? or Yup I’m Dead…Now What? The Deluxe Edition.

Amazon

Barnes & Noble

LuLu Marketplace

Amazon

Barnes & Noble

Lulu Marketplace

What’s the difference? The Deluxe Edition contains the 30 Day Challenge along with additional forms, resources, shortcuts and tips. The regular version refers to the website to download these items.

- Amazon is a tad quicker and convenient (if you have prime). I pretty much order everything from Amazon, so why would I not order my books, as well.

- Barnes & Noble is just B&N (some prefer)

- LuLu Marketplace takes a little longer, but is a few pennies cheaper and offers a convenient coil binding.

Whichever option you choose, you just need to choose one!

Don’t delay!

This is one of the most important things you can do for your Loved Ones.